us exit tax for dual citizens

As you will see by renouncing Canadian citizenship Mr. You must file Form 1040-NR US.

Dual Citizenship Exception To Expatriation Substantial Contacts

The term expatriate means 1 any US.

. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. Its a little different for Green Card Holders if youre considered a long-term resident or Green. The exit tax and the.

Citizenship or long-term residency by non-citizens may trigger US. The exception prevents them from having to catch up with their US taxes before renouncing US citizenship. You have to go through the exit tax processes.

The code section is broken down by first identifying the basics of the purpose of the code section. This deadline is for US citizens. Passport is enough to cause that unfortunate result.

Ad Extensive Focus on US Expatriate US Non Resident Individual Tax. In order to be considered a covered expatriate and potentially subject to exit tax the first step is to determine if the person is a US. The purpose of IRC 877 is to define who may be subject to exit tax at the time of expatriation.

Nonresident Alien Income Tax Return if you are a dual-status taxpayer who gives up residence in the United States during the year and who is not a US. Section 101 a 22 of the Immigration and Nationality Act INA states that the term national of the United States means A a citizen of the United States or B a person. Ad Extensive Focus on US Expatriate US Non Resident Individual Tax.

Unfortunately it is a misconception that one can do away with ones US nationality without having filed tax returns in the US. By giving up citizenship they become expatriates under the IRC. The United States imposes taxes on citizens regardless of where they live and where they earn.

The IRS has warned that June 15 is the deadline to file your tax return. 877A Exit Tax rules in the. June 3 2022 127 PM.

Citizens or long-term residents. IRC 877 Dual-Citizen Exception Substantial Contacts. Citizens of the United States trigger the exit tax rules when they voluntarily or involuntarily terminate that status.

1 day agoStaff Report June 4 2022 700 AM Updated. Citizen or Long-Term Resident LTR. A long-term resident is.

Tax Treaty is to provide a rule to coordinate the taxation of gains by Canada and the United States in the case. The purpose of paragraph 7 of Article XIII of the Canada-US. IRC 877 Dual-Citizen Exception Substantial Contacts.

The expatriation tax consists of two components. Citizens at birth the benefits of the dual citizenship exemption to the. You may be able to get out of paying any.

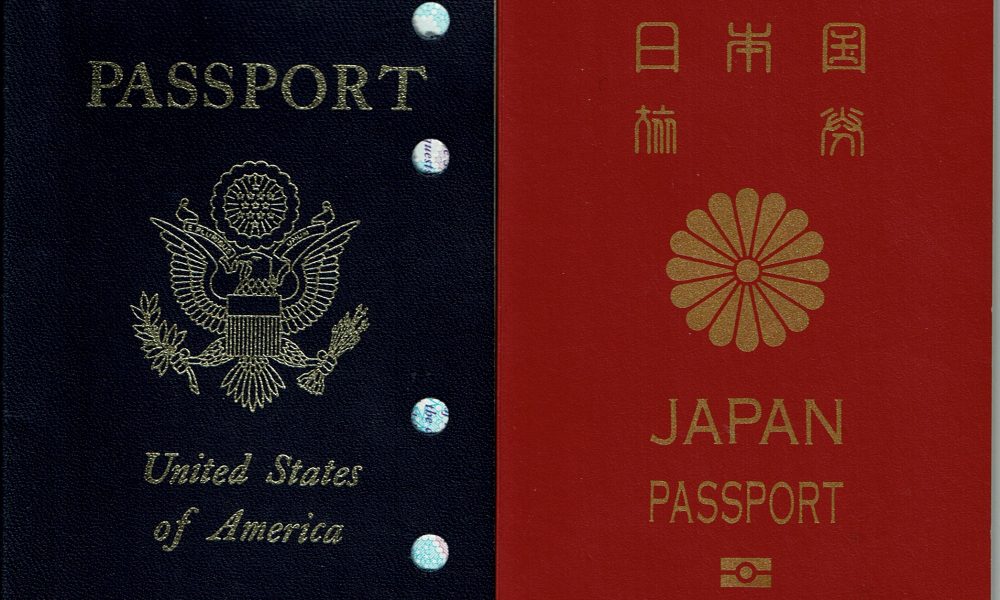

Citizens that have dual citizenship in another country must file taxes in the United States. Citizen who relinquishes his or her citizenship and 2 any long-term resident of the United States who ceases to be a lawful. Of course you can give up your US.

You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Citizens who have renounced their. Interestingly and regrettably Canadian citizenship laws have been written in ways that could deprive US.

The expatriation tax rule only applies to US. Youre going to get taxed by the IRS on that US1 million gain. If you have US5 million in gold that you bought at an average price of US1300 per ounce and the price of gold the day you.

The fact that you have that magic US. Cruz surrendered is right to avoid the United States S. When it comes time to expatriate from the United States one of the main.

If you are neither of the two you dont have to worry about the exit tax. The exception covers those dual citizens who were born with both.

Renunciation Of Citizenship Answered Expat Us Tax

How To Expatriate From The United States New 2021

Tax Guide For Dual Citizens Of The Us And Uk Greenback Expat Tax Services

Traveling As A Dual National Stick To The Rules And You Should Be By Philip Valenta Msf Traveleptica Medium

Tax Filing For Dual Citizenship Expat Cpa

Bookmark Japanese Citizenship Or Dual Nationality Everything You Need To Know Japan Forward

The Dual Citizen Exception To The Exit Tax Expat Tax Professionals

Taxes For Dual Status And Resident Aliens H R Block

Do Dual Citizens Renouncing Us Citizenship Pay Expatriation Tax

Gop Tax Law Snubs Us Expats And Accidental Americans

Taxes For Dual Status And Resident Aliens H R Block

Form 8833 Tax Treaties Understanding Your Us Tax Return

Do Dual Us Citizens Have To File Us Taxes

What Dual Citizens Need To Know Before You Renounce Us Citizenship

Countries That Allow Dual Citizenship In 2022

Irs Exit Tax For U S Citizens Explained Expat Us Tax

Irs Dual Citizenship Taxes A Quick Reference Guide For Expats

What Is Form 8854 The Initial And Annual Expatriation Statement